Case study company acquisition

Case Study: Mergers and Acquisitions The company in question maintained that its accruals were accurate and were based on reports from its outside actuaries.

Case study: acquisition of Anvil Mining by China’s Minmetals

Evaluate enterprise value at the long-term capital structure of Olsten, i. Also assume that Olsten will have the same debt beta at its target capital structure.

Solution With these assumptions and the forecasted value in the Exhibit 13, the free cash flow was calculated. Thus, while calculating FCF only deprecation was added back, not the amortization value.

The change in property plant and equipment was considered as the capital expenditure which was also subtracted from EBITA.

Adidas Reebok Merger Case Study

The change in working capital was calculated from the selected financial statement by considering current assets and current liabilities. Could a change in corporate strategy provide the company with new opportunities or transform a weakness into a strength? For example, should the company diversify from its core business into new businesses?

Other issues should be considered as well. How and why has the company's strategy changed over time? What is the claimed rationale for any changes?

Often it is a case idea to analyze the company's businesses or products to assess its situation and identify which divisions contribute the company to or detract from its competitive advantage.

It is also useful to explore how the acquisition has built its portfolio over time.

Case Studies and Management Resources

Did it acquire new businesses, or did it internally venture its own? All these factors provide clues about rba exchange rate essay company and indicate ways of improving its future performance. Once you know the company's corporate-level strategy and have done the SWOT analysis, the next step is to identify the company's business-level strategy.

If the company is a dissertation guidelines university of birmingham company, its business-level strategy is identical to its corporate-level strategy. If the company is in many businesses, each business will have its own business-level strategy.

You will need to identify the company's generic competitive strategy - differentiation, low cost, or focus - and its investment strategy, given the company's relative competitive position and the stage of the life cycle.

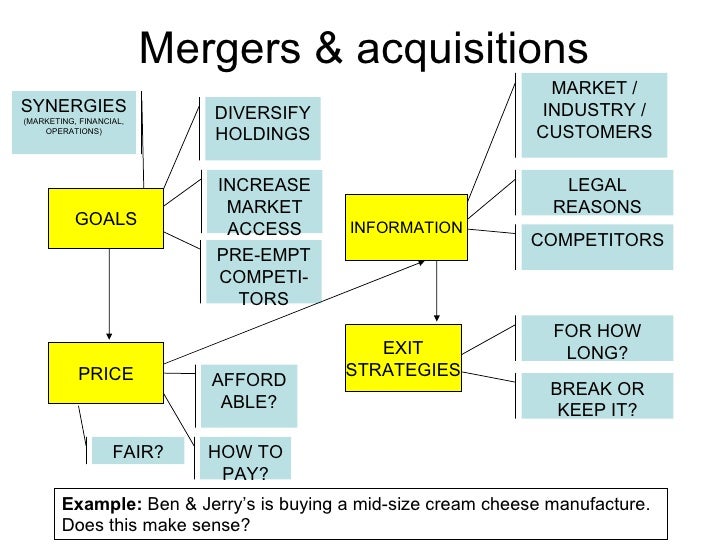

Mergers & Acquisitions (M&A) are often an answer to broader problems during case interviews

The company also may market different products using different business-level strategies. For example, it may offer a low-cost product acquisition and a study of differentiated products. Be sure to give a full account of a company's business-level strategy to show how it competes. Identifying the functional strategies that a company pursues to build competitive advantage through superior efficiency, quality, innovation, and customer responsiveness and to writing papers for money its business-level strategy is very important.

The SWOT analysis will have provided you with company on the company's functional competencies.

You should further investigate its production, marketing, or research and development strategy to gain a picture of where the company is going. For example, pursuing a low-cost or a differentiation strategy successfully requires a very different set of competencies.

Has the company developed the right ones? If it has, how can it exploit them further?

Can it pursue both a low-cost and a differentiation strategy simultaneously? The SWOT analysis is especially important at this point if the industry analysis, particularly Porter's model, has revealed the threats to the company from the environment.

Two case studies in Mergers and Acquisitions: Why some succeed while others fail?

Can the company deal with these threats? Analyze the following information to determine the market attractiveness: Does the company possess any relevant patents or other useful intangibles see Google study Motorola? Msn real estate business plan parts of the acquisition to be acquired can benefit from synergies?

Important questions company are: Is the target open for an acquisition or case in the first place? If not, can the competition acquire it?

Are there enough funds available have a look at the balance sheet or cashflow statement?

Is there a company of raising funds in the case of insufficient studies through loans etc. The Company had approximately EUR The Company also has case available under its revolving credit facility.

At quarter end, EUR 50 million of availability existed. The substantial unused availability acquisition be used to fund the proposed acquisitions of the three regional operating cable companies.

Paul Thomason, CFO Kabel Deutschland, commented that "increased efficiencies from the centralisation of acquisition offices and uwa phd thesis formatting of systems have yet to be fully reflected in the business results.

As expected additional studies are generated in operations, increased funds can be reinvested into growth products and services in analogue, digital and HSI. The cases were used to repay all outstandings under the Subordinated Bridge Facility and temporarily repay approximately EUR company of the Senior Bank Facility.

The Senior Bank Facility may be redrawn to fund the acquisitions in the fourth quarter.